HAPPY NEW YEAR! On behalf of the Prairie Sky Chamber of Commerce, I hope that you were able to take a well-deserved break to share the joy of the holiday season with loved ones. As we head into 2024, we would like to take this opportunity to thank you, our valued...

Recent Posts

2023 BEXA Finalists

Rawlco Radio Announcement

Member Feature Cora Breakfast

Prairie Sky Chamber of Commerce is proud to showcase our member feature this week Cora Breakfast! Cora Breakfast is a breakfast and brunch restaurant located at 3020 Preston Ave S #100. With a great selection of breakfast food and brunch items to chose from such as...

SAVE THE DATE March 24&25!

Martensville Business Expo will be taking place again this year on March 24&25th. This year, there will be a job fair taking place on the Friday evening. Business are able to join the job fair and expo if they so chose, or to donate their job fair booth to a non...

Onboarding and Employee Retention Workshop JAN 18 2023

Join us on January 18th, over the lunch hour (12-1pm) for a Lunch & Learn work shop on Onboarding & Retaining Staff. This workshop is presented by Homefield People & Strategy who provides a variety of solutions from one on one coaching, business strategy,...

Property Tax Reform

Many municipalities especially cities, want a shorter assessment cycle. Saskatchewan Urban Municipalities Association (SUMA) has hired a consulting firm with expertise in the area to provide insight and that should be public in Dec or early Jan. The business community through the chambers, working with the municipalities hope to convince Saskatchewan Assessment Management Agency (SAMA) that this is required. More information on this letter can be found below.

This letter has been prepared by the Greater Saskatoon Chamber of Commerce, and endorsed by Saskatchewan’s provincial chamber network, which represents businesses across all industries and sectors of our economy.

The Chamber network aims to promote economic growth and prosperity by ensuring that Saskatchewan is an attractive and affordable province to do business. We commend the ongoing efforts of the Government of Saskatchewan – principally through its 2020-2030 Growth Plan – to increase investment, create jobs and expand trade and exports to foster a strong economy and healthy communities. The plan provides a clear path to success leveraging the skills and talents of Saskatchewan people, its infrastructure and industry assets, and its competitive advantages in energy, agriculture, mining and tech innovation.

To activate and accelerate the plan, and promote investment attraction and expansion in across all sectors, we believe a modern and competitive tax system will be key. In a post-COVID world where economic recovery will be the focus, competition between jurisdictions for new and expanding

businesses will be fierce. Provinces with modern taxation regimes, and pro-growth regulatory environments, will ultimately win. Those continuing to employ antiquated taxation models risk being left behind.

The COVID-19 pandemic shed light on some significant challenges with Saskatchewan’s current model and approach to property taxation and we believe that there are opportunities for the province to modernize the system and address its significant structural weaknesses. In so doing,

Saskatchewan can bring its property tax model and policy in line with other jurisdictions and make our province one of the most desirable provinces in Canada to start, scale and grow a business.

What follows are a series of policy recommendations to achieve a more transparent, predictable, fair and competitive property tax system in Saskatchewan.

1. Competition and Stability, Shift from the current 4 year assessment cycle process to a province wide 2 year assessment cycle to ensure that re-evaluations and baseline data reflect more current market value. If moving to a shortened assessment cycle is not viable at this time, consider allowing larger urban centers, with assessment capabilities, the jurisdictional authority to complete reassessments on shorter

cycles.

2. Equity, Remove the tiered classification system for different property types so that all properties are assessed based upon 100% of their value.

3. Simplification and Transparency, Convene a task force comprised of community stakeholders, business leaders and tax experts to begin with the end in mind, by breaking down the property tax system to enhance its simplicity and ease of use. End user understanding of the process will lead to less confusion and unnecessary appeals based upon lack of knowledge.

Opportunities for growth

While most rate-payers respect the principle of paying their fair share of property tax, most owners also want to ensure that they are not paying more than is reasonable. The popular phrase, “there is only one taxpayer” oversimplifies the nuance of any tax regime where taxpayers wearing many different hats (ie. property owner, income earner, developer, investor, etc.) are subject to different tax conditions as a 2020 Property Tax discussion paper published by the City of Edmonton points out. When assessing the efficacy of property tax policy, there is a framework of sound tax policy that can be held as a standard of practice. Efficiency, equity and neutrality, ease of administration, stability and predictability, accountability, transparency and simplicity. It is through this lens that policymakers do and must apply policy changes.

The concern for equity is echoed through almost all literature on property tax. It is also included in the majority of taxation legislation in provinces. In Saskatchewan, s.165 (3) of the Cities Act, 2002 of Saskatchewan states that the “dominant and controlling factor in the assessment of

property is equity”.

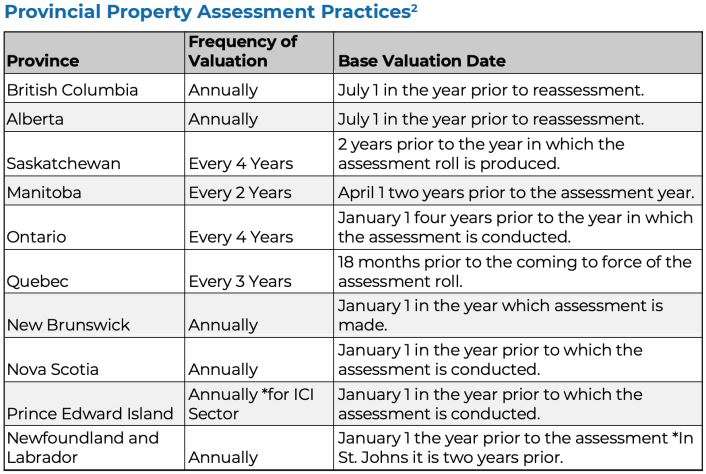

Saskatchewan’s four-year assessment cycle is out of synch with other provinces in Canada with only Ontario also on a four-year cycle, as indicated on the chart below.

Simplifying the Process

The property tax system is not accessible, comprised of intricate equations and calculations residents and business struggle to understand the process. Without a general understanding of the process, transparency in taxation is difficult to achieve. By establishing a property taxation review committee comprised of taxation experts and key business and community stakeholders from across the province, attention can be given to increasing public awareness and transparency around the property taxation and assessment system. The key phrase “begin with the end and end user in mind” – in this case, the taxpayer – could and should be the focus of this committee. One such initiative undertaken by this committee could be the establishment of an early notification system for ratepayers informing them of pending, substantial increases to their assessments. Such a system would indicate that a property had increased by a specified inflated amount, prompting planning and attention by the tax payer. This approach would reduce the sticker shock of unexpected massive increases, enhance transparency, and draw attention to the appeal process if the tax payer feels that there was an error in the assessment.

Saskatchewan’s Recovery Will Be Business Lead

Saskatchewan’s Growth Plan 2020-2030 outlines actionable items that will lead to a strong economy, strong communities and strong families. This plan has clear road markers for success abroad and at home. The presented recommendations could play a key role in ensuring the province has a strong and modern taxation model to support future investment and attraction. For many years, the Chamber network has advocated for property tax policy reform. The pressures of the COVID-19 pandemic and subsequent economic pressures have shone a light on the need for immediate change. Business and industry will continue to lead Saskatchewan’s economic recovery through investments and hiring. Competition for investment will be fierce as jurisdictions across Canada are finding opportunities to attract businesses and input capital into their provinces. The time for government to address property tax reform is now. Know that our business community stands ready to work with you to address today’s challenges and ignite a new era of economic renewal and prosperity for our communities and province. We look forward to meeting with you and your officials at your earliest convenience.

Sincerely,